How to Buy 5 Properties in 12 Months: A Step-by-Step Guide to Accelerate Your Real Estate Portfolio

1. Set Clear Goals and Build a Real Estate Strategy

Before you start purchasing properties, it’s crucial to outline your financial and investment goals. Are you buying properties for cash flow, appreciation, or a mix of both? Calculate how much passive income you aim to generate and how each property fits into that vision. Define your target property types, locations, and price ranges. A well-crafted strategy keeps you focused and avoids impulsive decisions.

2. Master Your Budget and Financials

Understanding your budget is non-negotiable. Assess your credit score, savings, and current debt-to-income ratio. Work with a financial advisor or mortgage broker to prequalify for loans and estimate how much you can comfortably afford. Consider using creative financing methods such as hard money loans, partnerships, or seller financing to expand your purchasing power.

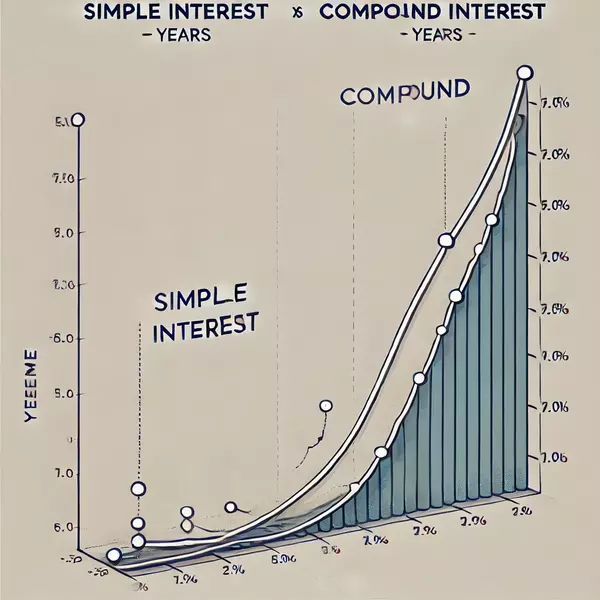

3. Leverage Real Estate Financing Strategies

To buy multiple properties in one year, leveraging financing is key. Start by identifying lenders that specialize in investment properties and explore various options, such as conventional loans, portfolio loans, or BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategies. Additionally, ensure that your initial property purchases create enough cash flow to support subsequent acquisitions.

4. Identify High-Potential Properties

Finding properties with strong return potential requires thorough research. Focus on neighborhoods with growing demand, favorable economic conditions, and infrastructure development. Use tools like the MLS, Zillow, or real estate investment platforms to identify undervalued properties or those with potential for improvement. Building a network of local real estate agents and wholesalers can also give you early access to off-market deals.

5. Build a Reliable Team of Experts

No investor succeeds alone. Surround yourself with a team of real estate professionals, including agents, contractors, property managers, and legal experts. A solid team helps you identify great deals, streamline renovation projects, and ensure compliance with local laws. Their expertise can save you time and money while reducing stress.

6. Diversify and Scale Strategically

Once you’ve purchased your first property, reinvest cash flow and use equity to fund your next purchases. Diversify across property types (e.g., single-family homes, duplexes, or multi-family units) or locations to minimize risk. Strategic scaling means balancing aggressive growth with caution to maintain financial stability.

7. Stay Disciplined and Track Progress

Consistency is the secret to hitting your 12-month, 5-property goal. Regularly review your progress, adjust your strategy as needed, and stay disciplined with your time and finances. Use tracking tools or apps to monitor cash flow, equity, and portfolio performance. Celebrate small wins along the way!

Final Thoughts:

Achieving the goal of buying five properties in a year requires a mix of determination, strategy, and adaptability. With clear goals, disciplined budgeting, and a strong team, you’ll be well on your way to building a profitable real estate portfolio. Remember, every successful property purchase is a step closer to financial freedom.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "