Why You Should Never Pay Off Your House Early

Learn why paying off your house early might not be the smartest financial move. Discover strategies to invest smarter and grow your wealth.

When we think of financial freedom, paying off your house often tops the list. But what if I told you that keeping your mortgage might be a better choice? Mortgage rates are historically low, and that opens the door to smarter ways to use your money. Let’s explore why rushing to pay off your house could actually cost you.

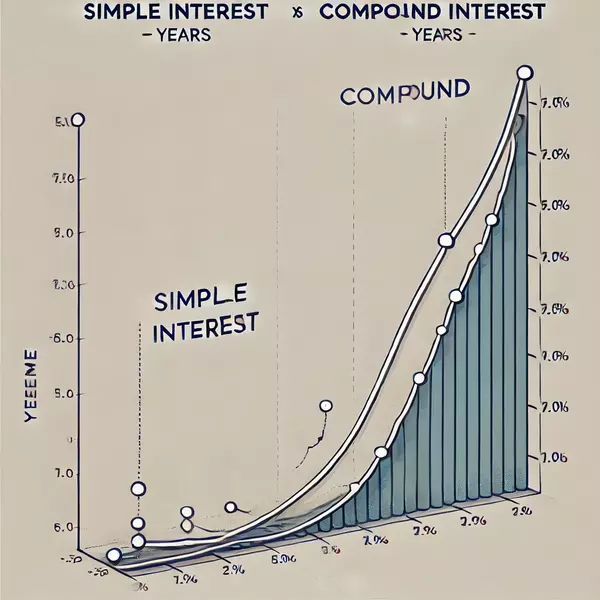

First, let’s talk about interest rates. Mortgages usually have some of the lowest rates you’ll ever find. Instead of paying off your home, consider putting that extra cash into investments like stocks or real estate. Historically, these options provide higher returns compared to the interest saved on your mortgage.

Liquidity is another key factor. Emergencies happen—medical bills, car repairs, or unexpected expenses. If all your money is tied up in your home, accessing it can be a nightmare. Keeping a liquid cash reserve ensures you’re always prepared for the unexpected.

Don’t forget about taxes! In Canada, mortgage interest could be tax-deductible under certain conditions. Paying off your house might eliminate these benefits. It’s like leaving money on the table, and nobody wants to do that.

Finally, let’s talk about inflation. Over time, the real value of your mortgage debt decreases due to inflation. That means the money you owe is worth less and less as years go by. It’s like having a built-in financial advantage.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "